target benefits center 401k

Make your retirement plan solid with tips advice and tools on individual retirement accounts 401k plans and more. Free backup care for all US.

Target Employee Benefits Breakdown Jobcase

In late August noting that converting subpar allegations into settlements has proven a lucrative endeavormostly for the lawyers bringing these lawsuits the US.

. Visit the resources page to learn more about the enhancements to the 401k plan and how and when to take action. I pretty much always worked a 8 hour shift. I work at a very busy super Target my first two weeks I requested mornings If possible.

Target Employee Health Benefits. I do it all at. Im a cashier also crossed train in back house as well.

401k plans are one of the most common investment vehicles that Americans use to save for retirement. Whether youre a student you have church or a second job. Investment options often include mutual funds exchange-traded funds and target-date funds These contributions are pre-tax which means they are deducted from your income before your income tax is calculated.

I averaged 3040 hours a week at my Target. To help you maximize your retirement dollars the 401k is an employer-sponsored plan that allows you to save for retirement in a tax-sheltered way. Seasonal team member benefits.

In this case your employer would put you in a fund named after your expected retirement year based on age. They genuinely try their best to fit you into a position that benefits both you and the needs of that particular department team. Rowe Prices 401k plan comes with many complementary features as well.

This article also covers other significant topics such as Target Profit Center Target EHR Target Compensation and Benefits Phone Number Target SSO and Target Race can be very helpful for people who. The primary plan is the Target 401k 401K plan. Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more.

This is a simple effective way to support the arts while reducing or eliminating significant often unanticipated tax penalties. It provides you with two important advantages. If youre young and currently in a low tax bracket but you expect to be in a higher tax bracket when you retire then a Roth 401k could be a better deal than a traditional 401k.

Benefits information above is provided anonymously by current and former Target employees and may include a summary provided by the employer. These are common among 401k plan menus and often the default option for participants who are automatically enrolled into their companies plans. Best for companies with less than 1000 clients T.

Chamber of Commerce filed an amicus brief in a suit filed last March. The probability illustrations also assume a consistent contribution percentage and asset allocation no future changes or rebalancing unless you are subscribed to a managed account or a target date asset allocation service annual inflation of approximately 2 and annual salary increases based on a calculation that incorporates multiple. I worked 7am 8am to 34pm most days give or take a hour.

Learn about Target including insurance benefits retirement benefits and vacation policy. Of those that dont have an automatic enrollment feature 534 say they already have a high participation rate and do not feel they would benefit and 131 think it would be too expensive due to increased cost of the match. Target is offering free access to additional resources that support mental emotional and physical health.

Glassdoor is your resource for information about Target benefits and perks. You can also schedule a oneonone appointment with a Transamerica Retirement Planning Consultant and register for an upcoming 401k Plan Essentials webinar. Learn about The Home Depot 401K Plan including a description from the employer and comments and ratings provided anonymously.

A federal judge has rejected a friend of the court filing in an excessive fee case against the American National Red Cross. Participation in 401ks has risen as pensions have become less common. Your eligibility for benefits may depend on the hours you work location of the storedistribution center and also the length of your service with the company.

More and more employees are investing in their futures through 401k plans. Second many employers provide. Taxes are a key consideration when it comes to deciding on a Roth 401k over a traditional 401k.

First all contributions and earnings to your 401k are tax-deferred. Glassdoor is your resource for information about the 401K Plan benefits at The Home Depot. The most common default investment option is a target-date fund present in 818 of plans.

Below is a rundown of Target benefits as well as an eligibility timeline. With 2 days off during the week. You can contribute up to 19500 in 2021 and 20500 in 2022.

Schwab Target Funds Schwab Market Track Portfolios Schwab Monthly Income Funds. Target employees receive numerous benefits including health insurance dental insurance vision benefits 401K enrollment in an Employee Assistance Program free counseling and legal advice and an employee discount of 10. Rollover IRA401K Rollover Options Combining 401Ks How to Rollover a 401K.

Employee 401k contributions for plan year 2021 will once again top off at 19500 with an additional 6500 catch-up contribution allowed. This is the general idea that drives the structure of target-date funds. Team members including discounts on tutoring and education resources as well as help with finding a nanny childcare center or caregiver through 8312021.

You can name Livermore Valley Performing Arts Center as the beneficiary of your IRA 401k or 403b retirement plan or life insurance policy. The tax benefits of 401ks are three-fold. You only pay taxes on contributions and earnings when the money is withdrawn.

A 401k can be one of your best tools for creating a secure retirement. For one it provides access to over 100 no-load mutual funds as well as 5400 non-proprietary funds. That being said Target is considered to offer an excellent benefits package including one.

Rowe Prices 401k offering comes with many benefits for both the employer and his or her employees. A 401k plan is established by the Target and the member can pay part of his salary up to 5. Benefits and Considerations of Mutual Funds Costs and Fees of Mutual Funds.

When a Roth 401k can make sense. Employees who participate in 401k plans assume responsibility for their retirement income by contributing part of their salary and in many instances by directing their own investments. Target is very flexible and accommodating for all situations.

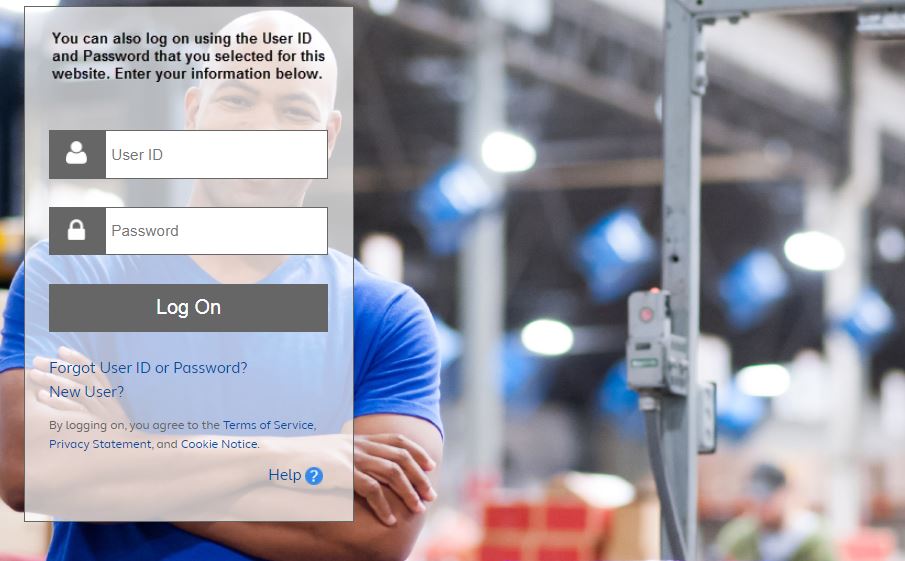

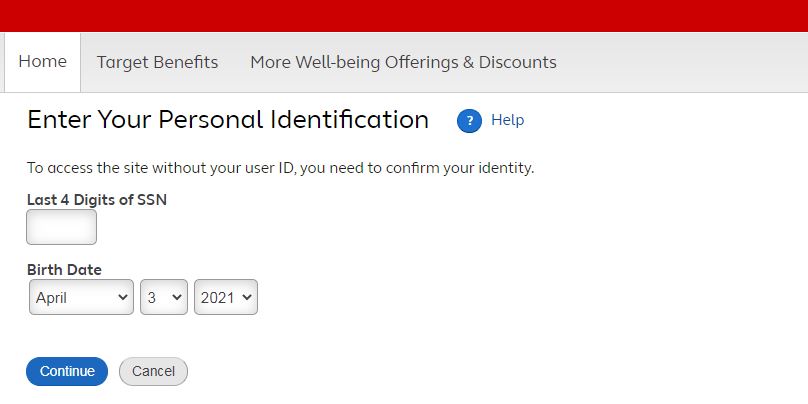

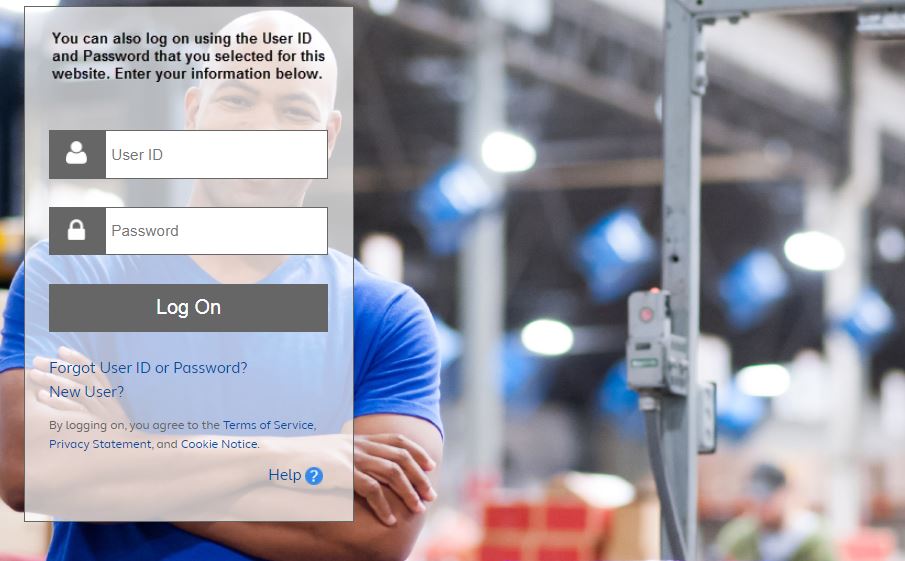

Target 401k Login Target Benefits 401k Login Official Portal Links

9 Target Employee Benefits Like Discounts And Vacation Time The Krazy Coupon Lady

401k Fintech Focus Tips To Ensure The Right Target Date Selection 401k Specialist

Target Pay And Benefits Www Targetpayandbenefits Com Target Employee Login

Targetpayandbenefits Www Targetpayandbenefits Com

Target Employee Benefits And Perks Glassdoor

9 Target Employee Benefits Like Discounts And Vacation Time The Krazy Coupon Lady

9 Target Employee Benefits Like Discounts And Vacation Time The Krazy Coupon Lady

Targetpayandbenefits Www Targetpayandbenefits Com

Target Employee Benefits Target My Pay And Benefits

9 Target Employee Benefits Like Discounts And Vacation Time The Krazy Coupon Lady

Target Employee Benefits Target My Pay And Benefits

Targetpayandbenefits Www Targetpayandbenefits Com

Target Employee Benefits Target My Pay And Benefits

Target Pay And Benefits Www Targetpayandbenefits Com Target Employee Login

Targetpayandbenefits Login Target Pay And Benefits Login Official

9 Target Employee Benefits Like Discounts And Vacation Time The Krazy Coupon Lady

Targetpayandbenefits Login Target Pay And Benefits Login Official